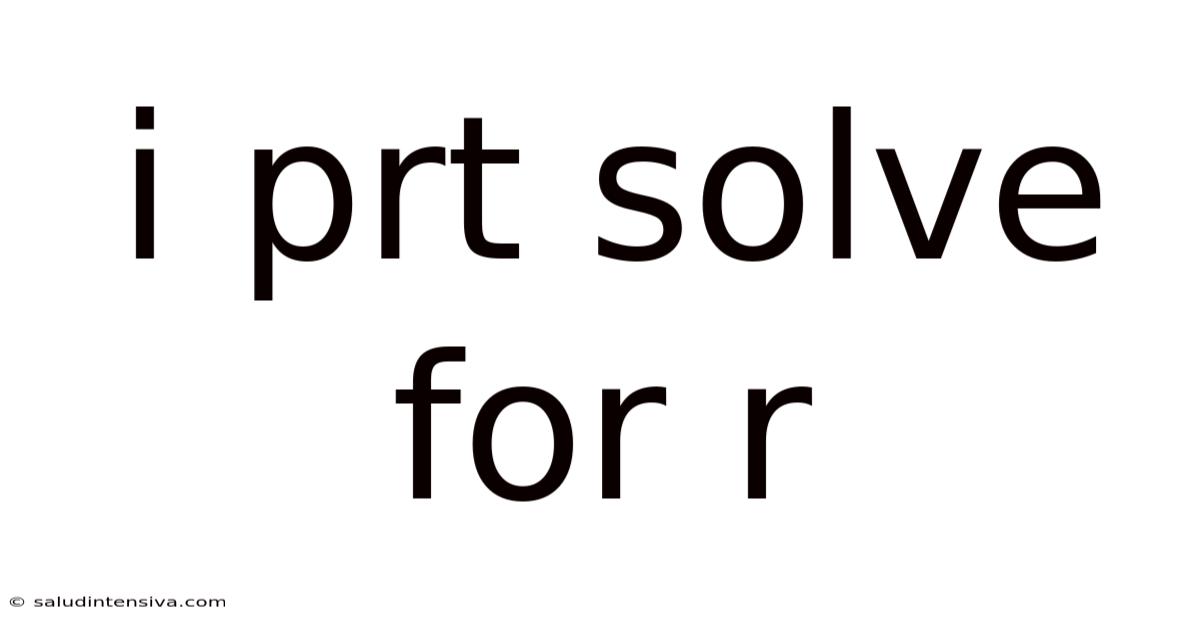

I Prt Solve For R

saludintensiva

Sep 03, 2025 · 6 min read

Table of Contents

Solving for 'r': A Comprehensive Guide to Interest Rate Calculations

Understanding interest rate calculations is crucial in various aspects of life, from managing personal finances to making informed investment decisions. Whether you're calculating simple interest, compound interest, or tackling more complex financial models, knowing how to solve for 'r' – the interest rate – is a fundamental skill. This comprehensive guide will walk you through different methods, providing clear explanations and practical examples to solidify your understanding. We'll cover various scenarios and address frequently asked questions, ensuring you become confident in solving for 'r' in any interest-related problem.

Introduction: Understanding the Importance of 'r'

The variable 'r' in interest calculations represents the interest rate, expressed as a decimal. It's a critical component in determining how much interest will accrue over a specific period. Accurately calculating 'r' is vital for:

- Personal Finance: Determining the true cost of loans, evaluating the returns on investments, and planning for future financial goals.

- Business Finance: Assessing the profitability of projects, making investment decisions, and managing debt.

- Economics: Analyzing economic growth, inflation, and monetary policy.

This guide will cover various scenarios, including simple interest, compound interest, and situations requiring the use of logarithms or financial calculators. We'll break down each method step-by-step, making even complex calculations accessible.

1. Solving for 'r' in Simple Interest Calculations

Simple interest is calculated only on the principal amount. The formula is:

I = P * r * t

Where:

- I = Interest earned

- P = Principal amount

- r = Interest rate (annual)

- t = Time (in years)

To solve for 'r', we rearrange the formula:

r = I / (P * t)

Example: You invested $1,000 (P) for 2 years (t), and earned $100 in interest (I). What was the annual interest rate (r)?

r = $100 / ($1,000 * 2) = 0.05 or 5%

2. Solving for 'r' in Compound Interest Calculations

Compound interest is calculated on both the principal amount and accumulated interest. The formula is:

A = P (1 + r)^t

Where:

- A = Final amount (principal + interest)

- P = Principal amount

- r = Interest rate (annual)

- t = Time (in years)

Solving for 'r' in this equation is more complex and requires the use of logarithms. The steps are:

-

Divide both sides by P: (A/P) = (1 + r)^t

-

Take the t-th root of both sides: (A/P)^(1/t) = 1 + r

-

Subtract 1 from both sides: r = (A/P)^(1/t) - 1

Example: You invested $1,000 (P) for 5 years (t), and your investment grew to $1,610.51 (A). What was the annual compound interest rate (r)?

r = ($1610.51/$1000)^(1/5) - 1 = 1.10 -1 = 0.10 or 10%

3. Using Logarithms to Solve for 'r' in Compound Interest

The logarithmic approach offers an alternative method, particularly useful when dealing with larger numbers or more complex equations. Starting with the compound interest formula:

A = P (1 + r)^t

We can use logarithms to solve for 'r':

-

Divide both sides by P: A/P = (1 + r)^t

-

Take the logarithm of both sides (using any base, commonly base 10 or natural logarithm, ln): log(A/P) = t * log(1 + r)

-

Divide both sides by t: log(A/P) / t = log(1 + r)

-

Use the antilogarithm (or exponential function): 10^(log(A/P)/t) = 1 + r (if using base 10 logarithm) or e^(ln(A/P)/t) = 1 + r (if using natural logarithm)

-

Subtract 1 from both sides: r = 10^(log(A/P)/t) - 1 or r = e^(ln(A/P)/t) - 1

Using the same example as above:

- log(1610.51/1000) / 5 = log(1+r)

- 0.021189 = log(1+r)

- 10^0.021189 = 1 + r

- 1.05 = 1 + r

- r = 0.05 or 5% (There's a slight discrepancy due to rounding during calculations)

4. Solving for 'r' with Financial Calculators and Spreadsheet Software

Financial calculators and spreadsheet software (like Microsoft Excel or Google Sheets) provide built-in functions that simplify solving for 'r'. These tools significantly reduce the computational effort, particularly for complex scenarios involving annuities, mortgages, or other financial instruments.

-

Financial Calculators: Most financial calculators have dedicated keys for solving for interest rates (often denoted as 'I/YR' or similar). You input the other known values (present value, future value, number of periods, payments), and the calculator directly computes the interest rate.

-

Spreadsheet Software: Spreadsheet software offers functions like

RATE(in Excel and Google Sheets) which directly calculates the interest rate based on the provided inputs. For example, in Excel, you would use the formula:=RATE(nper, pmt, pv, [fv], [type], [guess]), where:nper= number of periodspmt= periodic paymentpv= present valuefv= future value (optional)type= payment type (optional)guess= estimated interest rate (optional)

5. Addressing Different Compounding Periods

The formulas presented thus far assume annual compounding. If the interest compounds more frequently (e.g., semi-annually, quarterly, monthly), you need to adjust the 'r' and 't' values accordingly:

- Adjust 'r': Divide the annual interest rate by the number of compounding periods per year.

- Adjust 't': Multiply the number of years by the number of compounding periods per year.

Example (Monthly Compounding): An investment of $1,000 grows to $1,268.24 after 2 years with monthly compounding. Find the annual interest rate.

- Adjust 'r' and 't': Let the annual interest rate be 'r'. The monthly interest rate is r/12, and the total number of periods is 2 * 12 = 24.

- Apply the compound interest formula: 1268.24 = 1000(1 + r/12)^24

- Solve for r: Using logarithms or a financial calculator, you'll find r ≈ 0.12 or 12%

6. Frequently Asked Questions (FAQ)

-

Q: What if I don't know the final amount (A) but know the regular payments? A: This scenario involves annuities. Solving for 'r' in annuity calculations typically requires iterative methods or specialized financial calculators/software.

-

Q: How do I handle situations with irregular payments? A: Irregular payments complicate the calculation considerably. Numerical methods (like the Newton-Raphson method) or financial software are necessary to solve for 'r'.

-

Q: What about inflation's effect on the real interest rate? A: The nominal interest rate ('r' as calculated above) doesn't account for inflation. To find the real interest rate, you need to adjust the nominal rate by subtracting the inflation rate.

-

Q: Can I use online calculators? A: Yes, many websites offer free online calculators specifically designed for interest rate calculations. However, always ensure the calculator uses the correct formula for your specific scenario.

7. Conclusion: Mastering Interest Rate Calculations

Understanding how to solve for 'r' empowers you to make informed financial decisions. While simple interest calculations are straightforward, compound interest and more complex financial instruments require a deeper understanding of logarithms or the use of financial calculators and software. By mastering these methods, you'll gain valuable skills applicable in personal finance, business, and various other fields. Remember to always carefully consider the compounding frequency and account for factors like inflation when assessing the true cost or return of your investments. With practice and the resources mentioned in this guide, you'll become proficient in solving for 'r' and effectively managing your financial future.

Latest Posts

Latest Posts

-

2 1 3 As Improper Fraction

Sep 09, 2025

-

Round To Nearest Penny Calculator

Sep 09, 2025

-

20f Is What In Celsius

Sep 09, 2025

-

Lcm Of 12 And 13

Sep 09, 2025

-

4 Out Of 6 Percentage

Sep 09, 2025

Related Post

Thank you for visiting our website which covers about I Prt Solve For R . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.